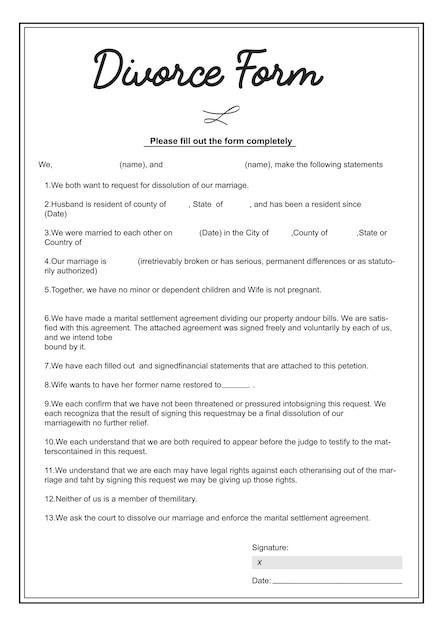

colorado last will and testament pdf

What is a Colorado Last Will and Testament?

A Colorado last will and testament is the standard legal vehicle with which people can determine what will happen to their assets after they die․ In a will, a person, known as a testator, specifies the recipients of their property, who are known as beneficiaries․

Purpose and Scope

The primary purpose of a Colorado last will and testament is to ensure that a person’s wishes regarding the distribution of their assets are carried out after their death․ This document outlines how the testator (the person making the will) wants their estate to be divided among their chosen beneficiaries․ The scope of a Colorado will encompasses all aspects of the testator’s estate, including real estate, financial investments, insurance policies, personal property, and any business interests they may have․ It allows the testator to appoint an executor to oversee the administration of their estate, and to designate guardians for minor children, if applicable․ This comprehensive approach ensures that the testator’s wishes are respected and that their loved ones are provided for after their passing․

Key Components

A Colorado last will and testament typically includes several key components․ These components are essential to ensure the validity and clarity of the document․ Firstly, it must include a clear statement that the document is the testator’s last will and testament, revoking any prior wills․ Secondly, it should identify the testator and their beneficiaries, specifying the nature and extent of the property being distributed․ The will should also appoint an executor, who will be responsible for carrying out the testator’s wishes․ Additionally, it may include provisions for guardianship of minor children, funeral arrangements, and charitable donations․ These components work together to create a comprehensive and legally sound document that reflects the testator’s wishes for their estate․

Requirements for a Valid Colorado Will

Colorado law specifies several requirements for a last will and testament to be considered legally valid․

Witness Requirements

In Colorado, a will must be signed by two credible witnesses who are at least 14 years old and not beneficiaries of the will․ These witnesses must sign the will in the testator’s presence, and the testator must declare to the witnesses that the document is their will․ The witnesses must also sign the will in each other’s presence․ It is important to note that the witnesses should not be anyone mentioned in the will to receive a portion of the testator’s estate․ Colorado expects generally competent witnesses to sign the document in the testator’s presence․

Content Requirements

A valid Colorado will must contain certain essential elements․ It must clearly identify the testator, or the person making the will, and state that it is their last will and testament․ The will must also name the beneficiaries who will inherit the testator’s property, and specify the exact nature of the property being distributed․ It’s crucial to include a statement revoking any previous wills, ensuring that the current will is the final and legally binding document․ Additionally, the will should name an executor, who will be responsible for administering the estate and carrying out the testator’s wishes․

Types of Wills in Colorado

There are two primary types of wills in Colorado⁚ last will and testament and living will․

Last Will and Testament

A Last Will and Testament is a legally-binding document that sets out how a person wants their estate to be distributed when they die․ A person’s estate includes any real estate, financial investments and accounts, insurance policies, personal property, and business interests they have․ It is a crucial part of estate planning, as it allows individuals to designate who will inherit their assets and who will manage their estate after their passing․ The testator, the person creating the will, can appoint an executor to oversee the distribution of their assets and ensure their wishes are carried out․

Living Will

A living will, also known as an advance directive, is a legal document that outlines a person’s wishes regarding their medical care in the event they become incapacitated and unable to make decisions for themselves․ It allows individuals to specify their preferences for life-sustaining treatment, such as artificial ventilation or feeding tubes, in situations where they are unable to communicate their wishes․ A living will is separate from a last will and testament, which focuses on the distribution of assets after death․ It is an important tool for ensuring that a person’s wishes regarding their end-of-life care are respected․

Benefits of Creating a Will

A will ensures your wishes are followed and protects your loved ones․

Estate Distribution

A Colorado last will and testament outlines how you want your assets distributed after your death․ This includes real estate, investments, bank accounts, insurance policies, personal property, and business interests․ By creating a will, you can designate specific beneficiaries to receive specific assets, ensuring your property goes to the people you intend․ You can also specify the percentage of your estate each beneficiary will receive, providing flexibility in distributing your assets according to your wishes․

Designation of Executor

A crucial aspect of a Colorado last will and testament is the designation of an executor․ The executor, also known as a personal representative, is the individual you trust to oversee the administration of your estate after your death․ This involves tasks such as gathering your assets, paying off debts, and distributing your property according to your will’s instructions․ Choosing a reliable and responsible executor is essential to ensure your wishes are carried out properly and your beneficiaries receive their rightful inheritance․

Protection of Beneficiaries

A Colorado last will and testament serves as a vital tool for protecting your beneficiaries’ interests․ By clearly outlining your wishes for the distribution of your assets, you ensure that your loved ones receive the inheritance you intended․ This protection extends beyond financial assets, encompassing personal property, real estate, and even business interests․ A well-crafted will minimizes the risk of disputes, ensuring that your beneficiaries inherit their rightful share without unnecessary legal battles or delays․

Free Colorado Last Will and Testament Templates

Access free Colorado last will and testament templates online, providing a starting point for creating your legal document․

Downloadable PDF Forms

Many websites offer downloadable PDF forms for Colorado last wills and testaments․ These forms are often free and provide a basic template for creating your will․ While convenient, using a downloadable PDF form may not be the best option for complex estate situations․ It’s crucial to understand that these forms are not legal advice and may not cover all aspects of your specific needs․ For complex estates or if you have unique circumstances, consulting with an estate planning attorney is strongly recommended․

Online Will Builders

Online will builders offer a more interactive and customizable approach to creating your Colorado last will and testament․ These platforms often guide you through a series of questions, allowing you to tailor the document to your specific wishes․ Online will builders often provide access to legal professionals for consultations if needed․ While convenient, it’s essential to ensure the online will builder is reputable and complies with Colorado law․ Remember, online will builders are not a substitute for legal advice, especially in complex estate situations․

Intestacy Laws in Colorado

These laws dictate how your assets will be distributed if you die without a valid will․

Distribution of Assets

In Colorado, if you die without a will, the state’s intestacy laws determine how your assets are distributed․ These laws prioritize your closest relatives, such as your spouse and children․ If you’re married, your spouse typically inherits your entire estate․ If you have children but no spouse, your children inherit your estate․ If you have both a spouse and children, your spouse usually inherits a portion of your estate, with the remainder going to your children․ If you have no spouse or children, your estate is distributed to your parents, siblings, or other close relatives, depending on the specific circumstances․

Appointment of Administrator

If you die without a will in Colorado, the court appoints an administrator to manage your estate․ The administrator is typically a close relative, such as a spouse or child, but the court can appoint another individual if it deems it necessary․ The administrator is responsible for collecting your assets, paying your debts, and distributing your remaining assets to your heirs according to the state’s intestacy laws․ The court can also appoint an administrator to handle your estate if you have a will but it doesn’t name an executor, or if the executor named in your will is unable or unwilling to serve․

Additional Considerations

Beyond the basics, there are several additional considerations for creating a Colorado last will and testament․

Inheritance Tax

While many states levy an inheritance tax on assets passed down from a deceased individual, Colorado does not have an inheritance tax․ This means that beneficiaries in Colorado do not have to pay any additional taxes on the assets they inherit․ However, it’s important to note that the federal government may still impose estate taxes on large estates, regardless of the state’s inheritance tax laws․ It’s always wise to consult with a tax professional to determine the potential tax implications of your estate plan․

Animal Trusts

In Colorado, you can establish an animal trust to ensure the care of your beloved pets after your passing․ This type of trust designates a specific individual or organization as the caretaker of your pet, providing instructions for their well-being and financial provisions for their care․ The trust can cover veterinary expenses, food, housing, and other necessities․ It’s essential to consult with an attorney to ensure your animal trust meets Colorado’s legal requirements and is properly structured to provide for your pet’s long-term care․

Legal Assistance

While free online templates can be a starting point, creating a legally sound Colorado last will and testament often requires professional guidance․ An experienced estate planning attorney can help you understand Colorado’s specific requirements, ensure your will reflects your wishes accurately, and address complex situations involving beneficiaries, assets, or potential challenges․ They can also advise on tax implications, guardianship arrangements, and other relevant considerations to safeguard your legacy and protect your loved ones․

Leave a Reply

You must be logged in to post a comment.